How to Skyrocket Your Real Estate Investor Credit Score

Bad Credit Repair is Only Intimidating to the Uninformed

Bad credit repair advice can easily lower your real estate investor score, or cause added years of negative items to remain on your report. That all translates into a loss of money, because lenders, insurance companies, and even mortgage companies are now increasing rates they justify with slightly less than perfect investor credit scores. Do-it-yourself bad credit repair is only intimidating to the uninformed. You can raise your score with the suggestions below. It really is more than just probable that you can raise your credit scores yourself, and correct negative items at the three major credit reporting bureaus.

Read on, and put these tips into action yourself:

79% Chance Errors Exist on Your Credit Reports Right Now

Even if you think you have outstanding credit you have 79% chance that there is an error on your report.

And 25% of those mistakes are called “material errors” that are the cause of credit denied. All this is researched by the Public Interest Research Groups in their 2004 survey of the three major American credit bureaus. Less harmful errors that may not get you denied credit, may lower your score sufficiently to increase the money you pay to borrow.

Repair Your Real Estate Investor Credit Scores Yourself the Right Way

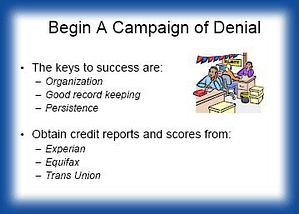

There’s no need to be afraid of doing your own credit repair. The detailed methods below are what Dennis J. Henson teaches as an ongoing program you put in place to repair your own bad credit. Using the techniques below you can see a dramatic increase in your own real estate investor credit scores.

Why start today? Why is it important to work on it now?

Because raising your credit score to desirable loan levels will take some time. How long? That depends upon the negative reports in your credit reports and how much organized effort you put into correcting problems. Major improvements can be seen in a very short time.

Can You Clear All Negative Reports From All Three Records

In some cases, yes, but the real truth is maybe. Most bad credit repair advice programs will tell you everything you want to hear in order to sell out-dated, rewritten material. The most serious damage from incorrect suggestions is that a simple misstep in a correspondence or phone conversation can be grounds for restarting the clock on a problem debt that was about to expire. So, it is possible to have negative entries removed, but some items may need to run their course. Even so, there are ways to lessen the damage those items have when a lender nitpicks over your credit reports.

Easy Credit Repair Tips

Follow these easy credit repair tips:

Get Organized – Disorganization leads to late or missed payments

Credit Reports – Order credit reports from the top three credit reporting companies

Examine Your Credit Reports to look for discrepancies and any problems that you need to fix.

Common errors to most look for according to the U.S. FTC factreport: “expect to obtain a variety of alleged errors: incorrect report of late payment; multiple reports of an account with late payment; paid account reported as delinquent; closed account reported as delinquent; incorrect financial account reported (“not mine”); incorrect collection balance; incorrect collection account reported; multiple reports of an account in bankruptcy; chapter 7 accounts discharged but reported as delinquent, as well as further types of alleged errors.”

Challenge Every Negative Entry